What Months Do You Pay Council Tax In Scotland

If you live with anyone else who is over 18 and liable to pay council tax read the page on council tax exemptions for more on this you have joint responsibility for paying the council tax.

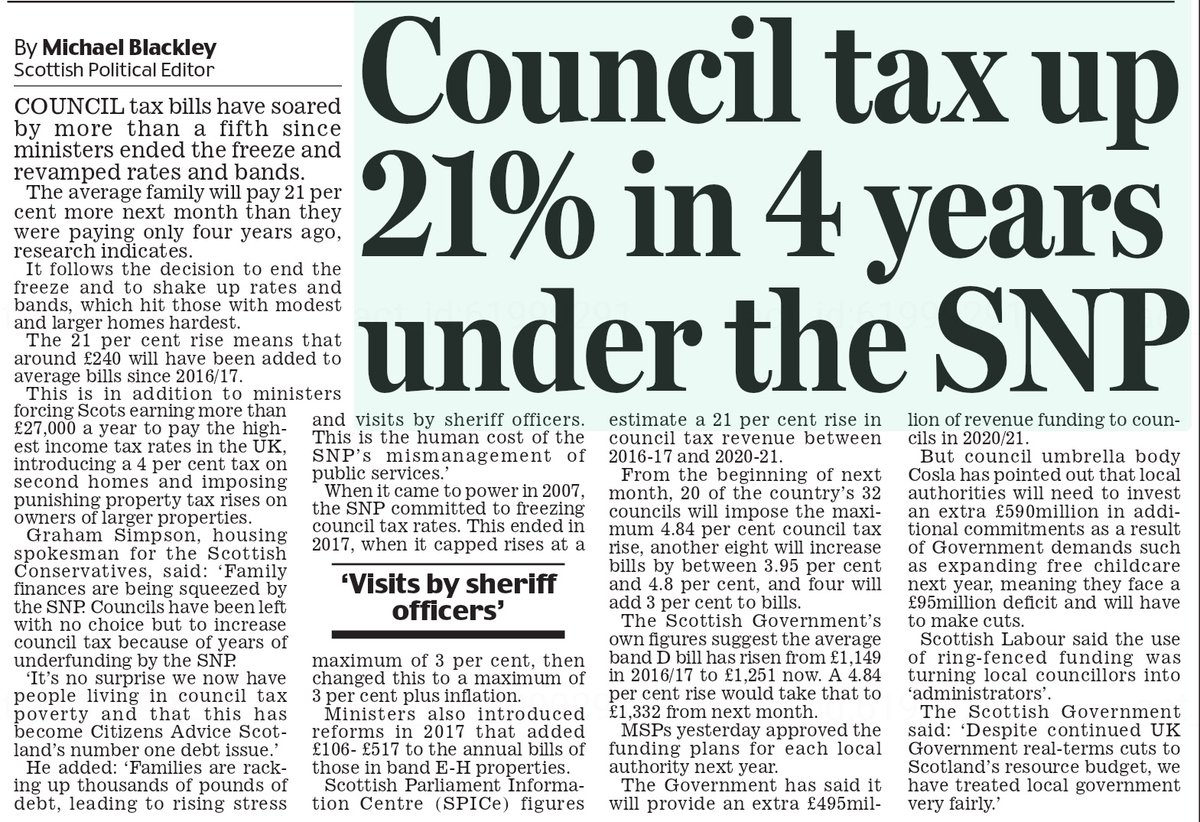

What months do you pay council tax in scotland. You could pay your council tax over 11 or 12 months picture. By the end of financial year 2018 to 2019 we will have invested more than 14 billion in ctr. To partners or lodgers. Our means tested council tax reduction ctr scheme reduces or eliminates the council tax liability of around 500000 lower income households in scotland depending on household circumstances and ability to pay.

If your property has been unoccupied for more than 12 months your council has the option to charge double the normal rate of council tax. Council tax is a necessary evil and used to pay for things like rubbish collection road maintenance and street lighting but do we have to pay council tax this month. This does not apply. Qualify for council tax benefit because your income is too high you may still be able to.

Increase the council tax by 100 for certain properties which have been empty for 1 year or more. This is called a surcharge. Paying council tax if you live with other people. February and march are the two months of the year when you dont pay council tax.

Grant no discount for empty homes. Claim if someone living with you is on income support or a low income. If you pay your council tax in 10 instalments you will be granted a tax break in your bill during february and march. If you think you may be eligible for council tax benefit you should contact the council.

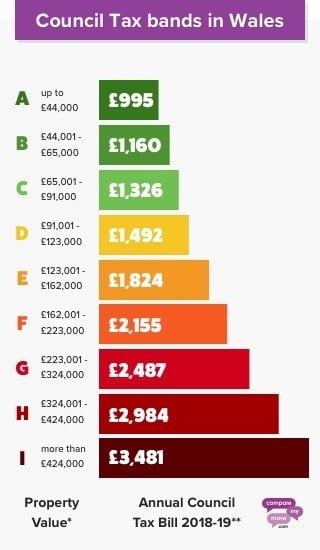

Council tax bills should be sent out by april. If you are a liable person but do not. The money collected from council tax payments helps to pay for local services such as rubbish and recycling collection and local area maintenance. Finding out your council tax band.

Council tax is usually split into 10 monthly instalments photo. You have the right to pay by 10 instalments. Council tax is payable to your local council. You can use our check my council tax tool to help you find out whether you are exempt from having to pay council tax or you are eligible for a discount or reduction in your bill.

By izzie deibe published. Registering for council tax. Visit your local council website for information about.