Do I Have To Pay Council Tax Living With Parents

Otherwise you can have someone earning say 100k pa getting a free house.

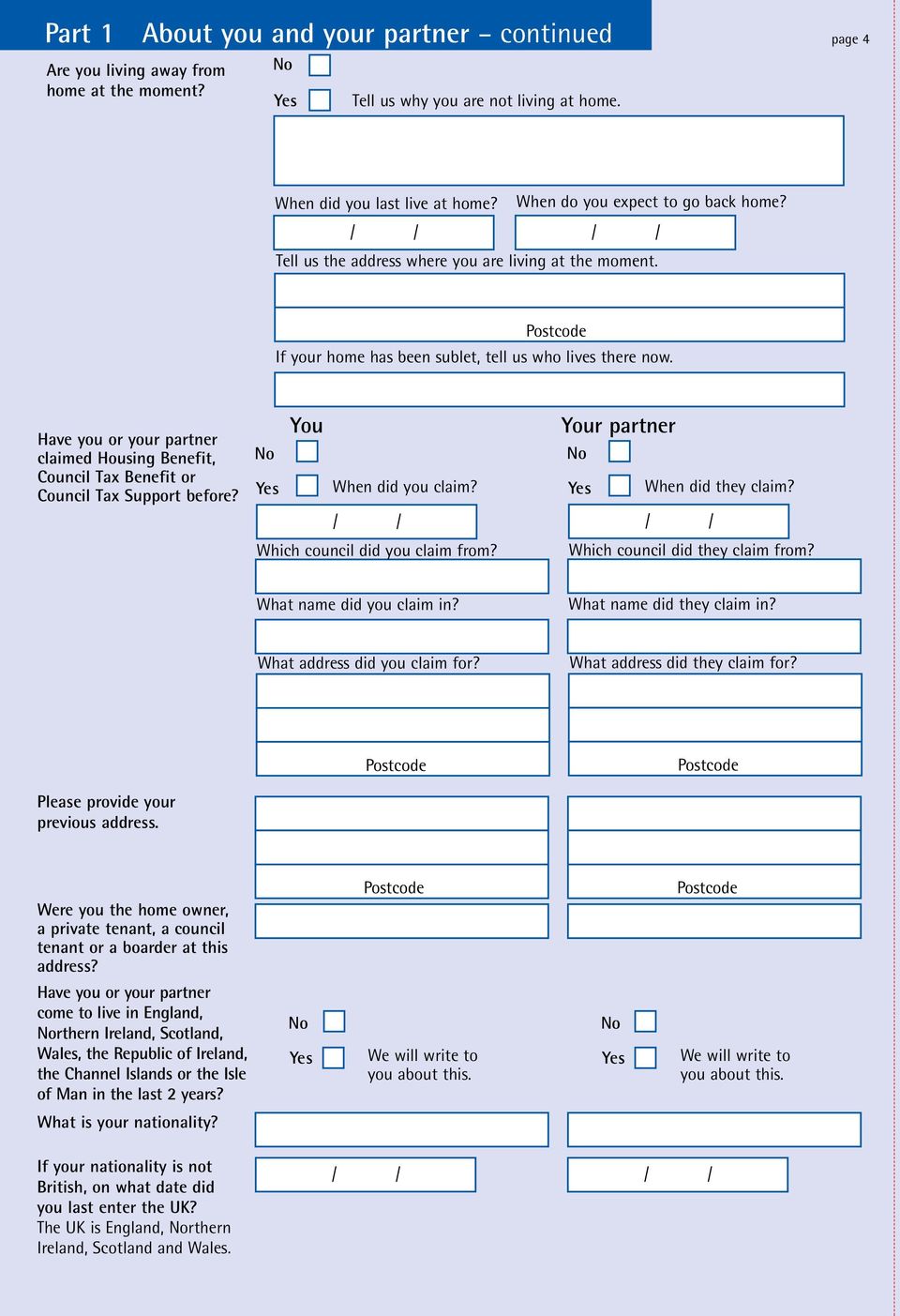

Do i have to pay council tax living with parents. What happens when an individual moves house. Presumably the people already living there have the same housing costs to pay regardless of how many family members moved back in with them. Council tax if living with parents. A look at the process of altering the council tax bill one will get.

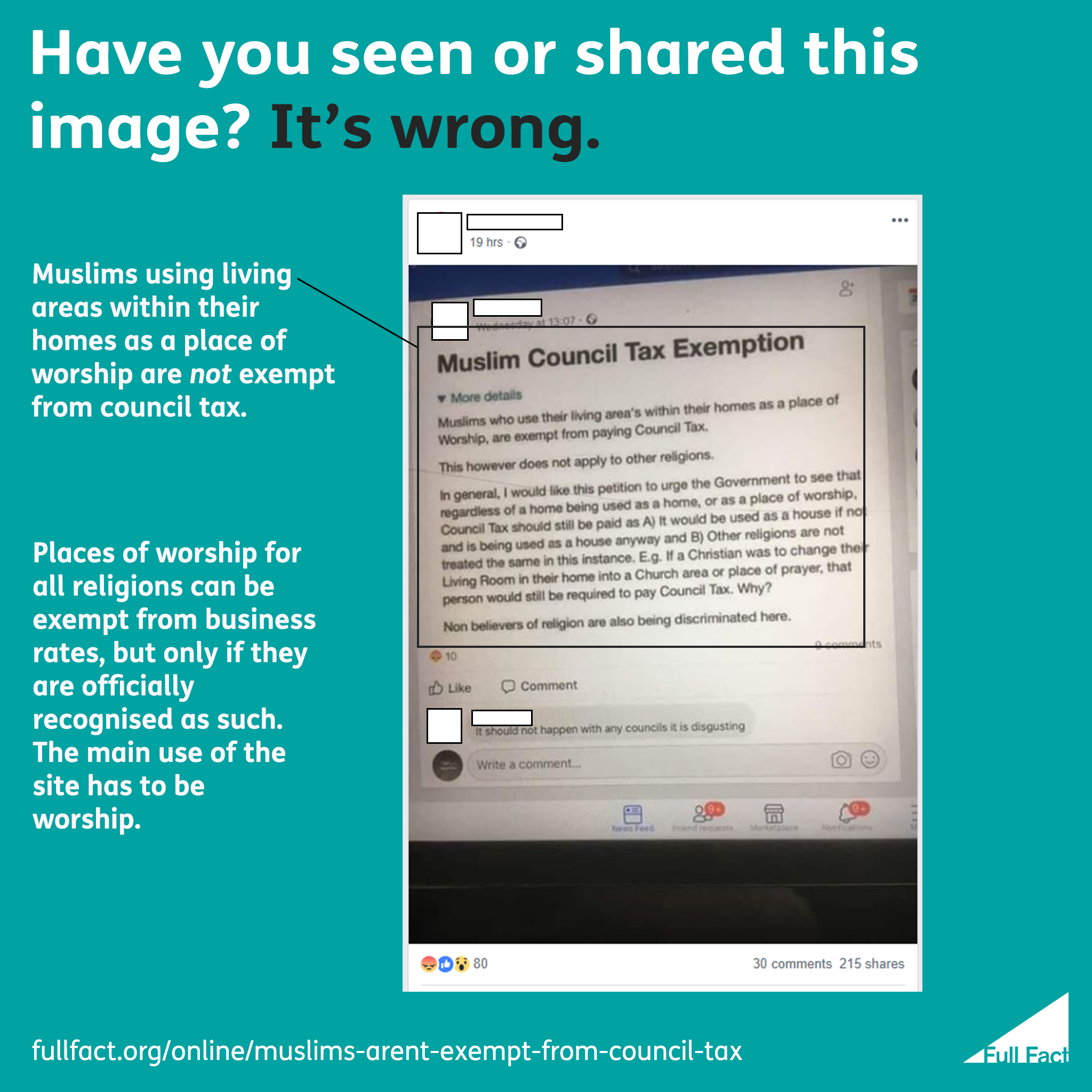

You are thinking perhaps of the old scrapped poll tax. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. The council doesnot need to know the names or number of people living there. All homes are given a council tax valuation band by the valuation office agency voa.

It is a tax on domestic property. Do i have to pay council tax when living with my parents answered by a verified uk tax professional. Youll usually have to pay council tax if youre 18 or over and own or rent a home. The council tax bill wont change unless youre going from employment to education and you personally wont have to pay anything.

Some people do not have to pay council tax and some people get a discount. Substantially or permanently disabled or. They need to know the name of the main resident owner tenant etc who is the account holder and pays the council tax. Last time i lived at home my parents paid the council tax of course but this time the circumstances are different.

The assumption is that op is paying keep. Council tax is a system of local taxation collected by local authorities. A relative is classed as dependant if they are. You dont have to pay anything towards the council tax and if theres only one adult eligible to pay in your house then they will receive a 25 discount.

Council tax is a payment which many renters and homeowners alike will have to pay. Some property is exempt from council tax. We use cookies to give you the best possible experience on our website. Over the age of 65.

She said i wont have to pay full council tax bill because i dont own the house but im unsure how much id have to pay because i cant find any info on it online. I think well im almost 100 sure that she doesnt pay council tax anymore. An annexe will be exempt which means you dont have to pay council tax if it is separately banded for council tax but forms part of another property and a dependant relative is living in it as their main or only home.