When Do I Have To Pay Council Tax

Should you not receive a revised bill its worth contacting your council to ask whether youre eligible.

When do i have to pay council tax. Some people do not have to pay council tax and some people get a discount. In 2014 the government scrapped what it called the unfair surcharge on family annexes which saw two separate council tax bills levied on the same home if it had a granny flat granny annexe or similar extension. Jay you are wrong. Find a postcode on royal mails postcode finder.

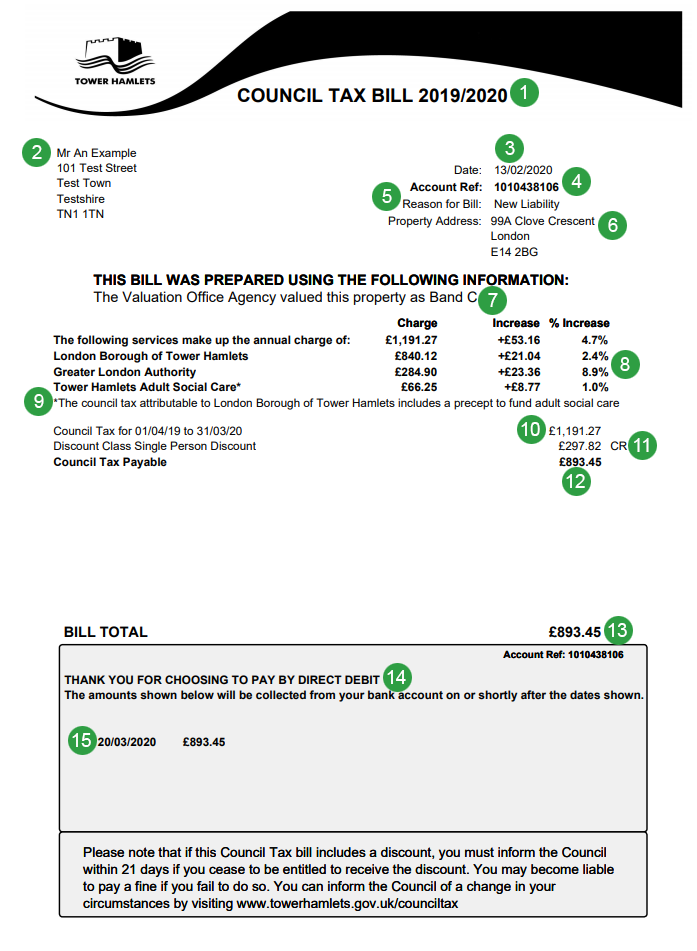

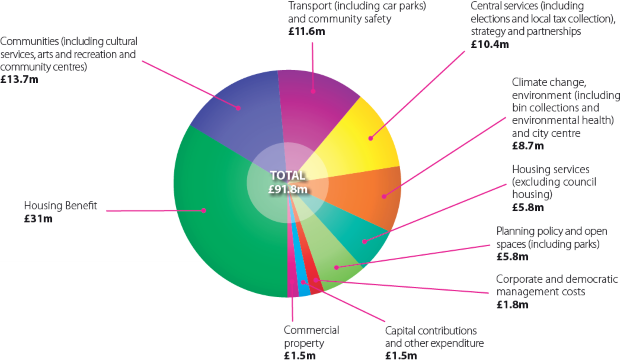

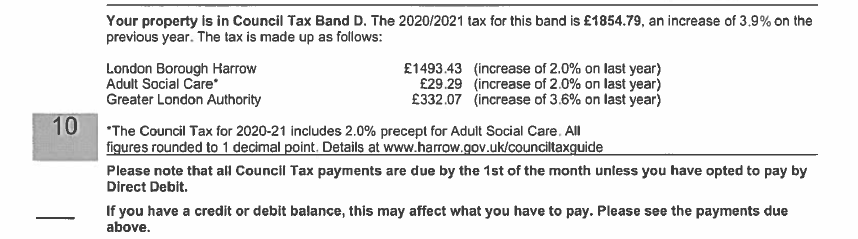

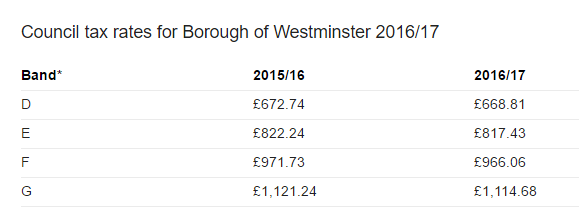

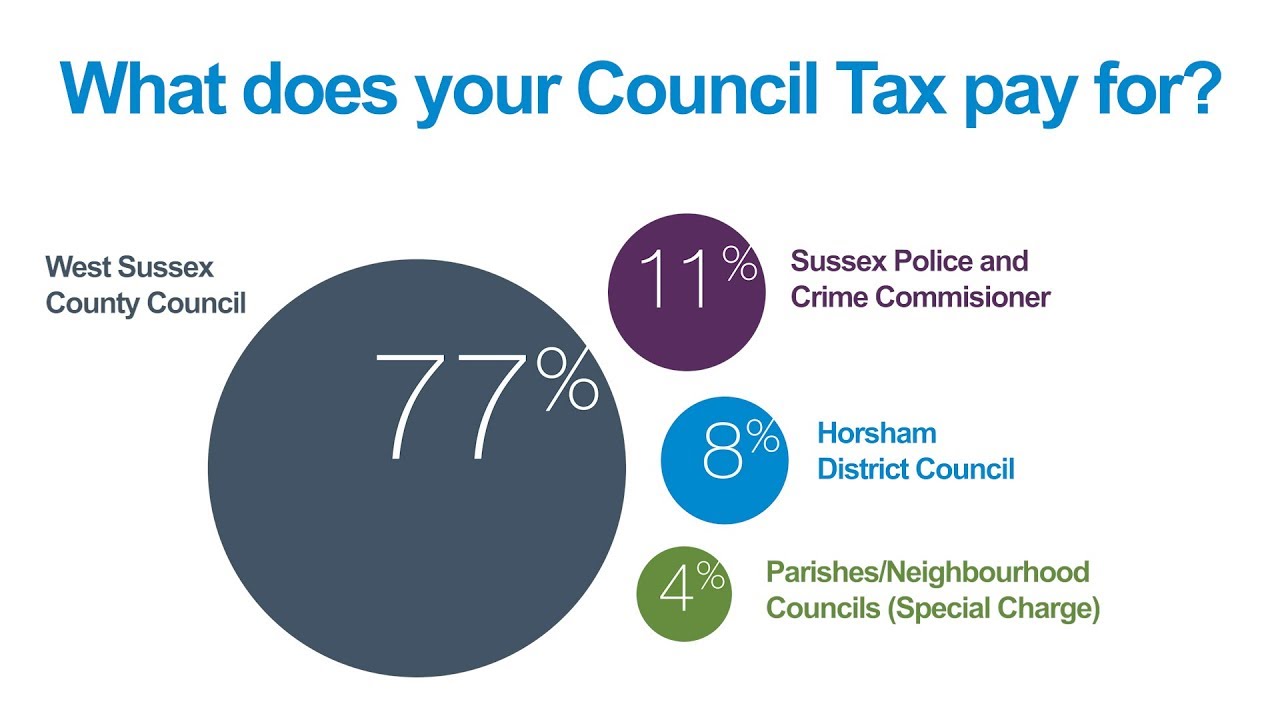

Although local councils are taking the burden of paying council tax into consideration as it stands most households will have to keep paying council tax as normal at the moment during the covid. Pay council tax online or by other methods such as direct debit. Council tax is a charge placed on those living in a british home to pay for the local council. It is a tax on domestic property.

What you need to know. Youll usually have to pay council tax if youre 18 or over and own or rent a home. An empty home can attract anti social activities and certain activities can harm the value of the property that you will have to pay in repairs and maintenance. A full council tax bill is based on at least 2 adults living in a home.

You state if you dont pay council tax you can be required to attend court a summons is not a voluntary invitation and you can go to prison. It came into being in 1993 to replace the hugely controversial community charge called the poll tax itself a replacement for the local rates system that had been around in some form for over three hundred years. Council tax is a system of local taxation collected by local authorities. Or if you have a bill of less than 150 you likely wont pay council tax at all.

The official stance on granny annexes and council tax. Do i have to pay council tax in a granny annex. One can pay less or get discount on council tax on empty property up to 50 in certain conditions. After receiving a council tax summons contact the court they will have no record of any summons.

Do you pay council tax on an empty property. For example sw1a 2aa find. Council tax may come as a nuisance for many people each month with amounts of the bill traditionally ranging from 50 or lower to more than 100 for certain local governments.