Do I Have To Pay Council Tax For An Empty Property

When an empty property is being sold after the death of the owner the property is exempt of council tax for 6 months after the granting of probate.

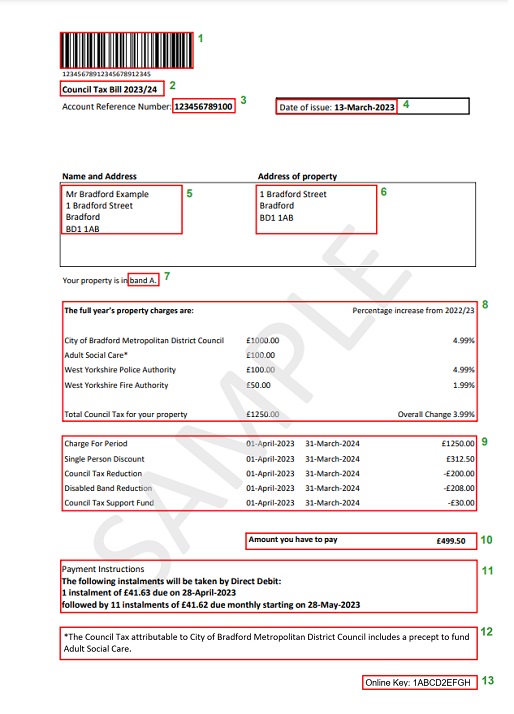

Do i have to pay council tax for an empty property. The national residential landlords association says a significant number of rented homes have been left empty because tenants have been unable to take up tenancies or have chosen to move out to be closer to family during the lockdown. The council tax payer will have to pay 300 of the council tax charge. As a landlord you do need to consider the issues of an empty property. You will usually have to pay council tax on an empty property but your council can decide to give you a discount.

How much of a discount is up to them. Properties empty up to six months for a property which is unoccupied and substantially unfurnished a discount applies for the first six months 100 for the first week then 40 for the remainder of the period. These include empty homes. Where a property has been unoccupied for over 2 years some councils will charge up to 50 additional council tax unless its an annexe or youre in the armed forces.

They have been able to charge this since 2013 at a rate of 50 of the council tax. Now that rate is 100 effectively meaning that an owner of an empty property might have to pay double the council tax. Some homes dont get a council tax bill for as long as they stay empty. Thankfully there is a way to avoid paying tax while a property is empty.

Youll usually have to pay council tax on an empty home but your council can decide to give you a discount the amount is up to them. Private landlords want the government to stop local authorities charging council tax on rented homes left empty because of the coronavirus. Council tax on empty property for sale on the rental market is unoccupied and unfurnished can get a claim in reduction by 100 for 6 weeks if it means empty. Should you purchase a property that is already empty you should check with the council the date the property first became empty and unfurnished to work out when a premium would start.

When it was introduced in april 2013 the council tax empty homes premium meant that councils were able to charge a premium of up to 50 of the council tax on a property that has been unoccupied. If the property has been empty for more than two years there is an additional council tax charge known as a premium. Of someone in prison except for not paying a fine or council tax.