Do I Have To Pay Council Tax In An Empty Property

This is called a surcharge.

Do i have to pay council tax in an empty property. Long term empty and unfurnished homes. Should you purchase a property that is already empty you should check with the council the date the property first became empty and unfurnished to work out when a premium would start. Thankfully there is a way to avoid paying tax while a property is empty. Where a property has been unoccupied for over 2 years some councils will charge up to 50 additional council tax unless its an annexe or youre in the armed forces.

Specifically were talking about paying council tax and the recent surcharge that is aimed at landlords with empty properties. Youll usually have to pay council tax on an empty home but your council can decide to give you a discount the amount is up to them. How much of a discount is up to them. Council tax on empty property for sale on the rental market is unoccupied and unfurnished can get a claim in reduction by 100 for 6 weeks if it means empty.

Councils have discretion to either. Contact your council to ask about a. These include empty homes. Of someone in prison except for not paying a fine or council tax.

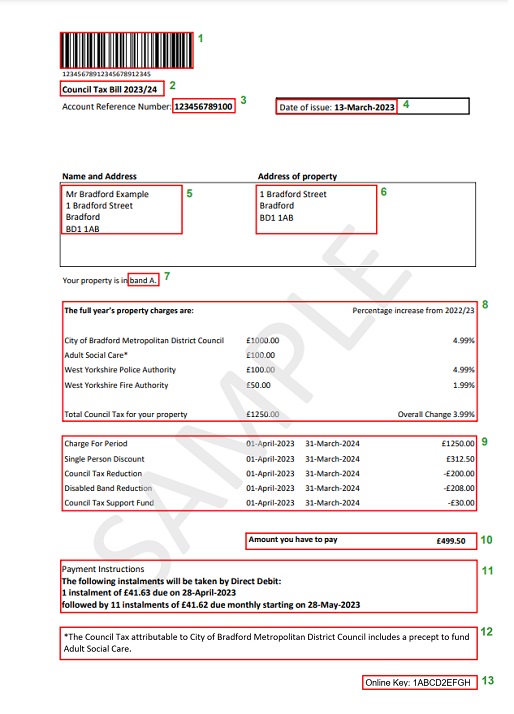

All homes are given a council tax valuation band by the valuation office agency voa. They have been able to charge this since 2013 at a rate of 50 of the council tax. Some homes dont get a council tax bill for as long as they stay empty. One may not be liable to pay for an empty property in case it was owned for charity purpose or it was previously occupied home for charity and is not a new build.

A full council tax bill is based on at least 2 adults living in a home. You will usually have to pay council tax on an empty property but your council can decide to give you a discount. Now that rate is 100 effectively meaning that an owner of an empty property might have to pay double the council tax. Grant no discount for empty homes.

Some property is exempt from council tax. Increase the council tax by 100 for certain properties which have. When an empty property is being sold after the death of the owner the property is exempt of council tax for 6 months after the granting of probate. If your property has been unoccupied for more than 12 months your council has the option to charge double the normal rate of council tax.

It is a tax on domestic property. The council tax payer will have to pay 300 of the council tax charge. Some people do not have to pay council tax and some people get a discount.